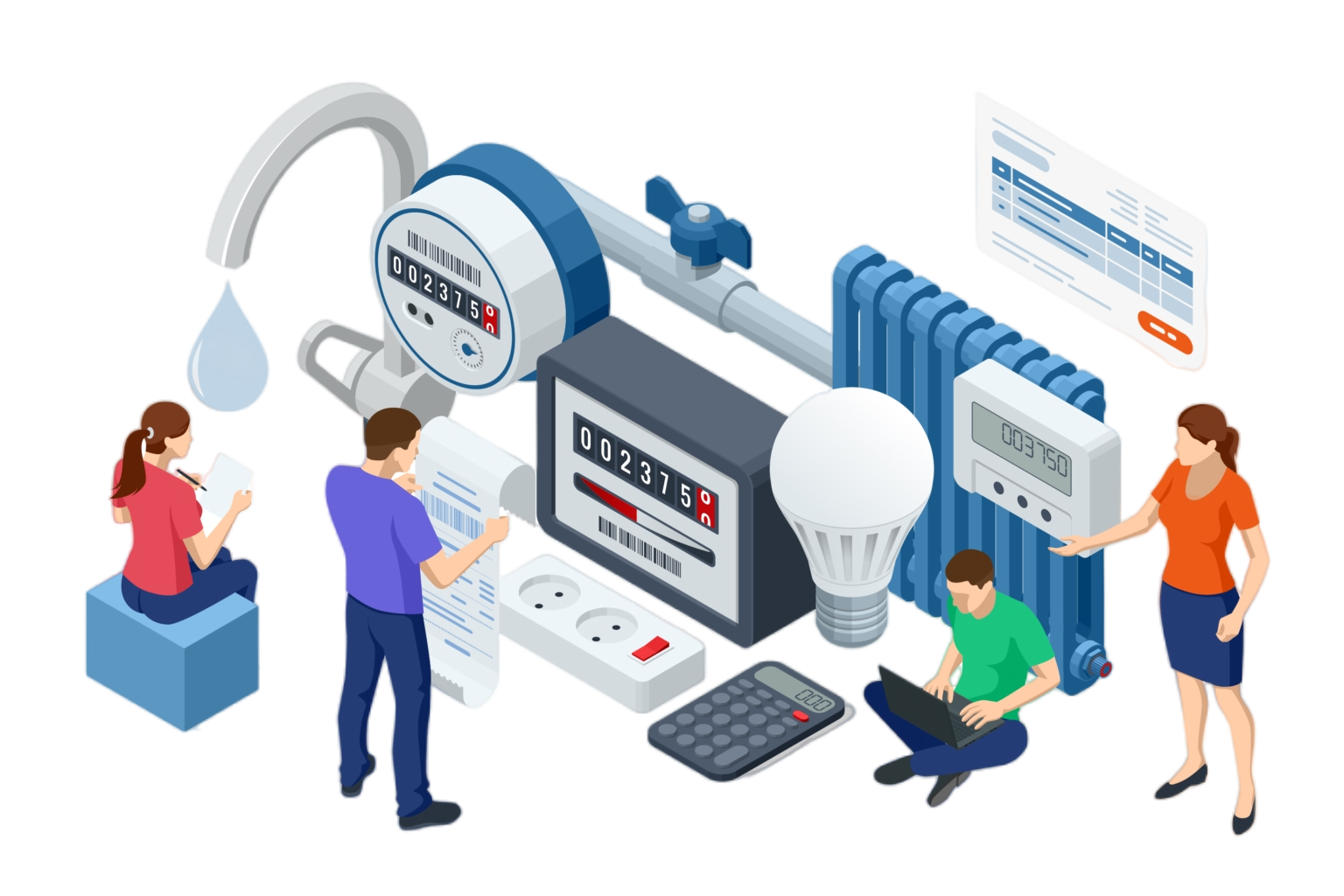

Home Efficiency Rebate +

The Home Efficiency Rebate Plus program provides up to $10,000 for energy-saving upgrades. Canada’s Greener Homes Grant provides rebates towards eligible retrofits such as home insulation, windows and doors, heat pumps, and renewable energy systems.